“Some decisions are consequential and irreversible or nearly irreversible – one-way doors — and these decisions must be made methodically, carefully, slowly, with great deliberation and consultation. . . . But most decisions aren’t like that — they are changeable, reversible — they’re two-way doors. . . . [These] decisions can and should be made quickly by high judgment individuals or small groups.”

Takeaway

Big companies stop being creative because, in large part, their decision-making processes become slower and more drawn out as they scale. Caution creeps in, and people are less likely to move quickly or place risky bets.

For Bezos, the problem is that people treat reversible decisions like momentous problems requiring caution. They miss opportunities that nimbler companies don’t.

To remain innovative as you grow, you need to understand which decisions are reversible and should be executed on quickly, and which have lasting consequences and should therefore be mulled over more slowly.

Challenge

Big companies are less tolerant of failure because they have more to lose, especially if they are public and have shareholders. Companies say they want to remain innovative, but they’re often not willing “to suffer the string of failed experiments necessary to get there.”

But it’s a mistake to take the overly cautious approach. “Every once in a while, when you step up to the plate, you can score 1,000 runs,” Bezos writes.

The key is figuring out how to marry the innovative spirit with the reality of risk aversion that exists at any large organization.

Solution

Amazon’s success, according to Bezos, is rooted in the company’s acceptance of risk.

“I believe we are the best place in the world to fail,” he writes, “and failure and invention are inseparable twins. To invent you have to experiment, and if you know in advance that it’s going to work, it’s not an experiment.”

The way Amazon achieves its risk acceptance mentality, according to Bezos, is through acknowledging which decisions can be easily reversed (and should therefore be decided on by small, fast-moving teams) and which cannot (and should therefore be more carefully considered).

“Failure and invention are inseparable twins.”

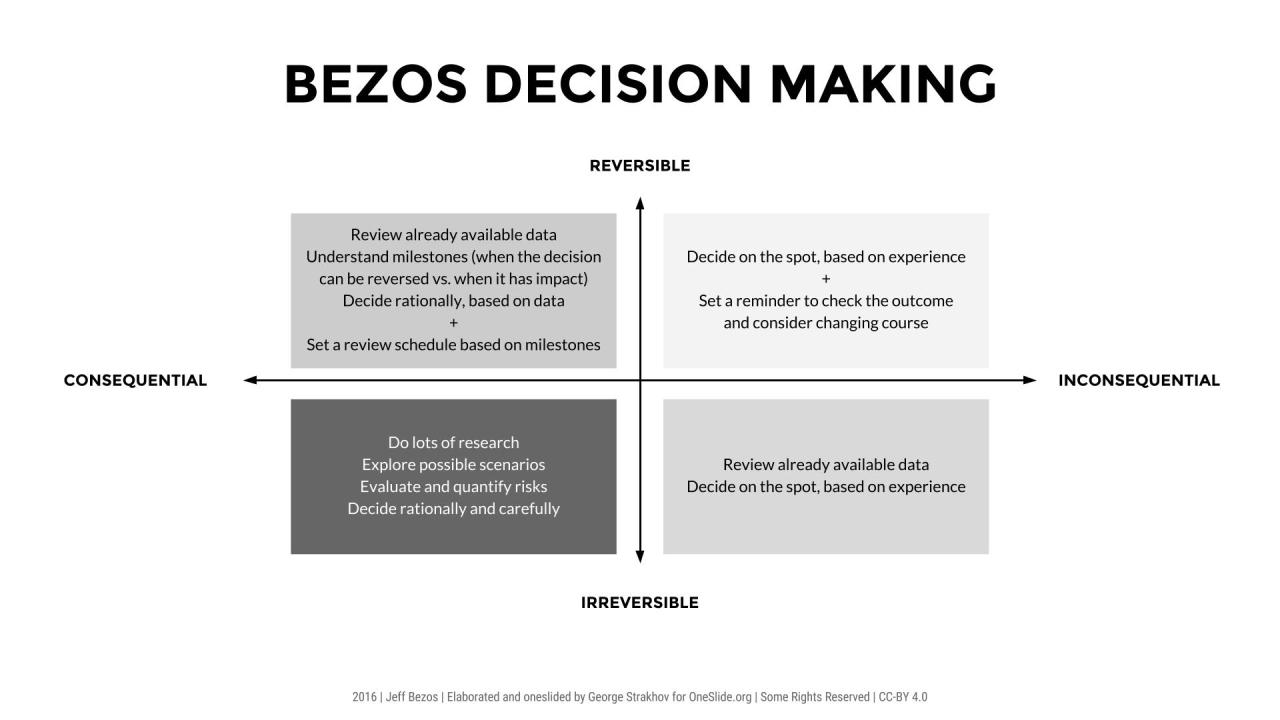

He refers to these as two different types of decisions, Type 1 and Type 2.

Type 1 decisions are almost impossible to reverse. They’re “one-way doors.” Type 2 decisions, on the other hand, can easily be reversed. They’re “two-way doors.”

Type 1 decisions should be made slowly and with caution, and Type 2 decisions should be executed quickly.

Mistaking Type 2 decisions for Type 1 slows the team’s pace. It leads to unchallenged risk aversion. And, in the end, it means less innovation.

Bezos’ advises to figure out what types of decisions your organization is making and treat them accordingly. Don’t treat lighter Type 2 decisions like Type 1 decisions. When you know you can reverse the outcome if you don’t like it, don’t get too mired in details and projections (no one will know the outcome until it actually occurs), and don’t let the project suffer death by committee. Just execute.

Jeff Bezos letter to shareholders 2015

Jeff Bezos has been writing a letter to shareholders since 1997 and looking at all if them gives an insight to the organisation and a masterclass in leadership. This is a series of short blogs that gives you a snap shot / key takes outs of each letter, along with links to them all.link to all letters to shareholders

- 1997: Bring on shareholders who align with your values

Jeff Bezos Letter to Shareholders 1997

- 1998: Stay terrified of your customers

Jeff Bezos Letter to Shareholders 1998

- 1999: Build on top of infrastructure that’s improving on its own

Jeff Bezos Letter to Shareholders 1999

- 2000: In lean times, build a cash moat

Jeff Bezos Letter to Shareholders 2000

- 2001: Measure your company by your free cash flow

Jeff Bezos Letter to Shareholders 2001

- 2002: Build your business on your fixed costs

Jeff Bezos Letter to Shareholders 2002

- 2003: Long-term thinking is rooted in ownership

Jeff Bezos Letter to Shareholders 2003

- 2004: Free cash flow enables more innovation

Jeff Bezos Letter to Shareholders 2004

- 2005: Don’t get fixated on short-term numbers

Jeff Bezos Letter to Shareholders 2005

- 2006: Nurture your seedlings to build big lines of business

Jeff Bezos Letter to Shareholders 2006

- 2007: Missionaries build better products

Jeff Bezos Letter to Shareholders 2007

- 2008: Work backwards from customer needs to know what to build next

Jeff Bezos Letter to Shareholders 2008

- 2009: Focus on inputs — the outputs will take care of themselves

Jeff Bezos Letter to Shareholders 2009

- 2010: R&D should pervade every department

Jeff Bezos Letter to Shareholders 2010

- 2011: Self-service platforms unlock innovation

Jeff Bezos Letter to Shareholders 2011

- 2012: Surprise and delight your customers to build long-term trust

Jeff Bezos Letter to Shareholders 2012

- 2013: Decentralize decision-making to generate innovation

Jeff Bezos Letter to Shareholders 2013

- 2014: Bet on ideas that have unlimited upside

Jeff Bezos Letter to Shareholders 2014

- 2015: Don’t deliberate over easily reversible decisions

Jeff Bezos Letter to Shareholders 2015

- 2016: Move fast and focus on outcomes

Jeff Bezos Letter to Shareholders 2016

- 2017: Build high standards into company culture

Jeff Bezos Letter to Shareholders 2017

- 2018: Wandering is an essential counterbalance to efficiencyJeff Bezos Letter to Shareholders 2018

One thought on “Don’t deliberate over easily reversible decisions”