“Math-based decisions command wide agreement, whereas judgment-based decisions are rightly debated and often controversial, at least until put into practice and demonstrated. Any institution unwilling to endure controversy must limit itself to decisions of the first type. In our view, doing so would not only limit controversy — it would also significantly limit innovation and long-term value creation.”

Takeaway

Some decisions can be made with data, but many of the important business decisions can only be made with judgment.

Many opportunities with fantastic upside won’t make sense in the short-term — to identify these, you have to think about what makes the most sense for your customers.

Challenge

When opening a new fulfillment center or deciding how much of a product to hold in inventory, you can always look a existing data to figure out the option that will most improve the customer experience.

But huge, business-making improvements — like Amazon’s decision to create Amazon Prime — often don’t have clean math behind them. According to the models Amazon had at the time, Prime actually seemed like a terrible idea. Often, your best decisions will.

Solution

When trying to weigh personal instincts versus quantitative models, use the customer experience to tip the scales.

Decisions that make sense on paper but don’t improve the customer experience may have limited upside. Decisions that undeniably benefit your customers can have significant upside, and sometimes the potential upside is so big that it’s worth risking the numbers not working out.

When Amazon first considered a free shipping service like Prime, quantitative models pointed to raising prices on shipping, not to making shipping free. If it raised prices, the models said, the company probably wouldn’t lose that many customers and it would make a lot more money.

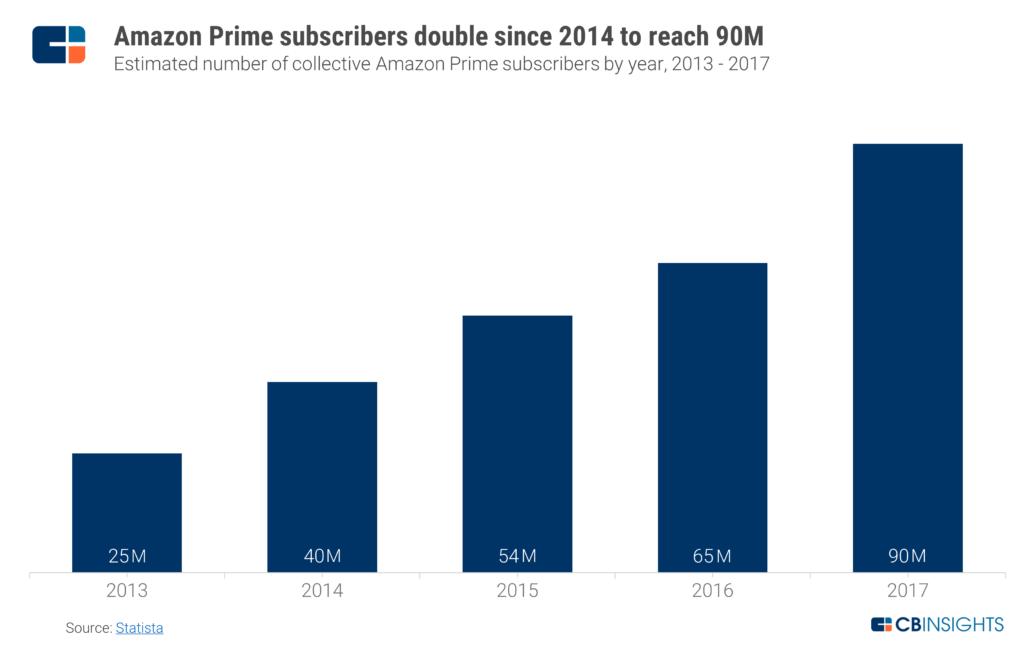

If Amazon had focused just on that data when deciding whether or not to introduce Prime, it would not have rolled out the service. But the team’s judgment was simple: if they kept lowering prices, it would lead to a greater volume of purchases, and ultimately that would mean greater customer loyalty over the long term. That bet paid off.

Jeff Bezos has been writing a letter to shareholders since 1997 and looking at all if them gives an insight to the organisation and a masterclass in leadership. This is a series of short blogs that gives you a snap shot / key takes outs of each letter, along with links to them all.

link to all letters to shareholders

- 1997: Bring on shareholders who align with your values

Jeff Bezos Letter to Shareholders 1997

- 1998: Stay terrified of your customers

Jeff Bezos Letter to Shareholders 1998

- 1999: Build on top of infrastructure that’s improving on its own

Jeff Bezos Letter to Shareholders 1999

- 2000: In lean times, build a cash moat

Jeff Bezos Letter to Shareholders 2000

- 2001: Measure your company by your free cash flow

Jeff Bezos Letter to Shareholders 2001

- 2002: Build your business on your fixed costs

Jeff Bezos Letter to Shareholders 2002

- 2003: Long-term thinking is rooted in ownership

Jeff Bezos Letter to Shareholders 2003

- 2004: Free cash flow enables more innovation

Jeff Bezos Letter to Shareholders 2004

- 2005: Don’t get fixated on short-term numbers

Jeff Bezos Letter to Shareholders 2005

- 2006: Nurture your seedlings to build big lines of business

Jeff Bezos Letter to Shareholders 2006

- 2007: Missionaries build better products

Jeff Bezos Letter to Shareholders 2007

- 2008: Work backwards from customer needs to know what to build next

Jeff Bezos Letter to Shareholders 2008

- 2009: Focus on inputs — the outputs will take care of themselves

Jeff Bezos Letter to Shareholders 2009

- 2010: R&D should pervade every department

Jeff Bezos Letter to Shareholders 2010

- 2011: Self-service platforms unlock innovation

Jeff Bezos Letter to Shareholders 2011

- 2012: Surprise and delight your customers to build long-term trust

Jeff Bezos Letter to Shareholders 2012

- 2013: Decentralize decision-making to generate innovation

Jeff Bezos Letter to Shareholders 2013

- 2014: Bet on ideas that have unlimited upside

Jeff Bezos Letter to Shareholders 2014

- 2015: Don’t deliberate over easily reversible decisions

Jeff Bezos Letter to Shareholders 2015

- 2016: Move fast and focus on outcomes

Jeff Bezos Letter to Shareholders 2016

- 2017: Build high standards into company culture

Jeff Bezos Letter to Shareholders 2017

- 2018: Wandering is an essential counterbalance to efficiency